The sabre rattling has begun: Bavaria and Hesse. “We are in solidarity, but not stupid”, dictated by Horst Seehofer, the journalists into the microphone, and then initiates the next Phase of the system change process. Are counted the hours of the countries financial compensation, as we know it?

Professor Wolfgang Scherf answers the most important questions in an Interview with BR.

Is entitled to a claim?

Scherf says that the lawsuit is, in principle, justified, since the financial equalisation leads to unjust results. Because there are inconsistencies in the design of the system.

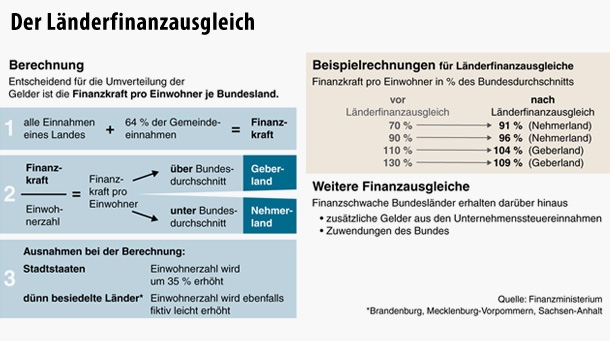

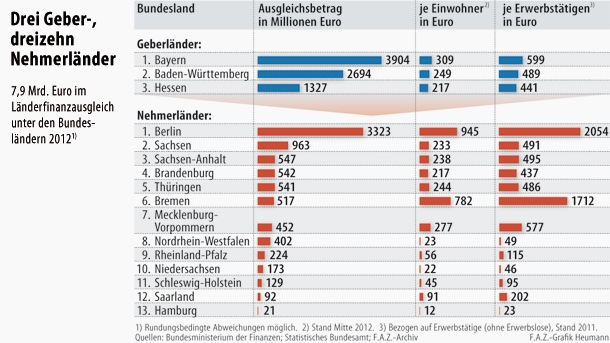

Berlin is an extreme example, because the state benefits from the city-States of rating, i.e., a population in terms of financial allocation, and 35% more than a resident of a surface state. At the same time, Berlin is benefiting from the build-up-Ost-Status, because it counts as a new state, and receives assignments, so-called Federal Supplement. Scherfs conclusion: Berlin has to balance over more tax money per capita than Bavaria.

What are we to think of incentives to reward the one who keep the house well?

As Professor Scherf – it is problematic, performance incentives in the financial equalisation system. But currently, the tax and financial strength is not reflected necessarily in the financial position. A recipient country has in the end less in the budget, although the wage increase tax revenues. And this is clearly a Disincentive.

Bavaria and Hesse have with their argument, right?

Populist, called Scherf, the arguments on the expenditure side of the budget. The countries themselves determine what the priorities for the use of taxpayers ‘ money. Now, if Berlin decides to free day-care centres, it does not mean that Bayern could not do this. The countries financial compensation problem is on the revenue side, not on the output side.

Click here for the Audio Interview.

In his Non-students to read values basics-the Textbook “Public Finance” taught the basics of financial science. The focus of the public budget, public expenditure, General and special taxation, the public debt, as well as the financial compensation.

The overall economic aspects of the state activity and the corresponding cycle, the theoretical analysis Wolfgang Scherf are always a big concern and are therefore emphasised here. Due to the strong relation to practice, the book offers a good access to the current financial political discussion. To The Book.