In his new Textbook, microeconomics Professor Thomas Siebe explains the strength of the market and the consequences for the customer loyalty strategy with the two-compartment broken price paragraph function (PAF) according to Gutenberg.

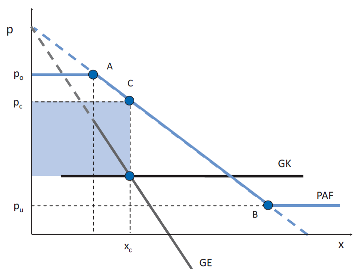

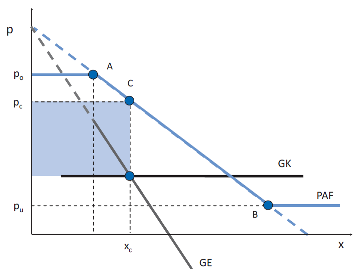

Within certain limits, a provider may therefore binds customers and how a Monopolist prices. With the increase of the price of the preferential ties lose their importance. The figure shows the course of such a PAF with the “kink points” A and b For prices above po, the provider loses its entire sales volume. From the price, p,u play preference bonds is also no longer an issue. To the lower price limit, the provider can sell as many “no name”products. Between the prices po and pu is the monopolistic area. The profit-maximising quantity of xc is obtained by equating of marginal solve marginal cost.

To the PAF this corresponds to a Price pc. The preferential binding is also siphoned off a portion of the Consumer surplus. For individual providers, it is therefore attractive, your brand, differentiate it from competing products. Unlike in the Cournot monopoly is the judge of that from the point of view of the consumer to be positive. A certain degree of heterogeneity makes it possible to meet differentiated customer needs better – the selection is simply greater. In addition, the “Power of the brand will be” limited, if it is possible, on close Substitutes to avoid.

To the PAF this corresponds to a Price pc. The preferential binding is also siphoned off a portion of the Consumer surplus. For individual providers, it is therefore attractive, your brand, differentiate it from competing products. Unlike in the Cournot monopoly is the judge of that from the point of view of the consumer to be positive. A certain degree of heterogeneity makes it possible to meet differentiated customer needs better – the selection is simply greater. In addition, the “Power of the brand will be” limited, if it is possible, on close Substitutes to avoid.

The stronger the preference bindings fail, the less the consumers react to price increases. In the case of very steep sections of the PAF price and limit fall apart cost – in this case, the profits will be greatest. The providers, on heterogeneous markets is therefore obliged to make the monopolistic area as large as possible and its product, taking into account the resulting marginal cost – to differentiate your product.

Market power is the price elasticity of demand measure. Market research results of individual companies are usually not published. Studies based on simulated purchases showed that in weak heterogeneous brand articles elasticities between -10 and -5. In this range of values of an independent price policy hardly worth it. Only when a product is clearly different from competing products, the result is monopolistic.

The two-compartment broken price paragraph function has a predominantly descriptive character. As an explanation model fails, because the location of the boundary prices and the slope of the price-sales function can be defined in the monopolistic sector can hardly be universally valid. An analysis of the overall market is missing. The merit of this approach is to set the pricing policy in a context with other sales policies. The possibility of additional gains creates an incentive for product differentiation. By nonprice competition, the individual provider is trying to take his monopolistic area as far as possible to extend.

Just customer retention strategies play in the Marketing a prominent role. It analyses customer satisfaction can go a first offense. The binding is intensified by the customer clubs or Payback systems. In some industries, it goes even to the individualization of customer relationships in electronic markets – the keyword here is “know your customer”. Supported by ever-cheaper storage capacity some companies have to collect a volume of data about their customers, the consumer organizations and privacy advocates makes legitimate Concerns.

The Text comes from the Textbook by Thomas sieves: micro Economics – division of labour, market, competition; UTB, 24,99 € (D), 275 pages , ISBN 978-3-8252-3789-9.

Article image: © Alexander Dreher / pixelio.de